Relationship coffee and the threat of tariffs

What we love most about specialty coffee are the connections we make with each other. We call it relationship coffee. When things are good, there’s a sense of ease, going with the flow. But there are moments that challenge relationships.

Right now, a lot of us are trying to make sense of the challenge that tariffs could mean, not just for the U.S. coffee industry, but also the wider implications for the global coffee industry.

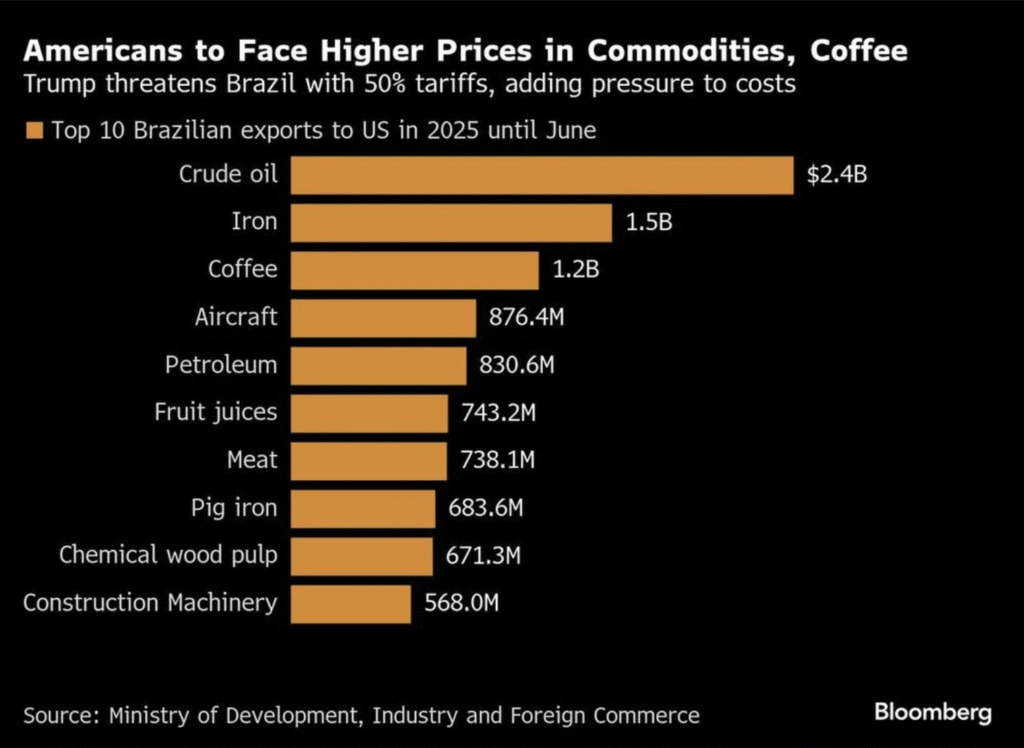

As it stands, Americans face a 50% tariff on Brazilian coffee. Practically speaking, if we bought a sub 80 point Brazilian coffee today at market level for September delivery at $3.70/lb FOB, tariffs would push it to $5.55/lb FOB. That’s before any of our own import or logistical costs. To give a sense of scale: that means any importer would pay at the point of customs roughly $77,700 more per container of C-market level coffee.

For many importers, large and small, the economic impact is huge. It likely means most will stop buying from Brazil, at least for now. If the tariff holds, we might not see any Brazilian coffee on U.S. spot lists for a long time. In the short term, many are holding back their purchases to see what happens next.

This will affect how roasters source their coffees. As reported in The Business Standard, has reported on roasters already looking outside of Brazil, creating a new kind of demand scarcity.

There’s also the possibility that some Brazilian coffee will be rerouted and rebagged through Mexico or Panama attempting to reduce the tariff impact to 10–15%, according to Debajyoti Bhattacharyya of AFEX Ltd because, “Without a strong traceable supply chain, tariffs are meaningless. I mean, we can’t stop oil from flowing, why would coffee?”

Politics has entered coffee in a way we haven’t seen for the last 35 years. This is a clear reminder that markets and governments are closely intertwined. And in a globalized world, products like coffee can absolutely become bargaining chips.

That seems to be what’s happening now: coffee being used as leverage by the Trump administration in its trade maneuvering with Brazil over the prosecution of Brazilian president Jair Bolsonaro.

And unlike other countries facing tariffs, Brazil has a sizable trade surplus with the U.S., giving it room to consider alternative options. They’ve filed a request with the WTO and are trying to get coffee exempted from the tariff list working alongside The Congressional Coffee Congress. At the same time, Brazil’s Ministry of Agriculture is considering subsidies to help support the coffee, beef, fruits, and fish industries until a resolution is found.

No single country can immediately replace the 8 million bags of coffee the U.S. typically sources from Brazil every year. But long-term, China is emerging as a major player. So far for 2025 China has imported over 500,000 bags from Brazil. On top of that, 183 new Brazilian coffee companies were approved to export to China.

Vinícius Estrela, director of the Brazil Specialty Coffee Association, said: “This is not a normal number. Authorizations usually happen in batches of 20 or 30.” Brazil and China have been working on bilateral agreements for over a decade. A significant recent MoU (Memorandum of Understanding) for coffee was signed for $1.4 billion USD and over 4 million bags, purchased by Luckin coffee to be delivered over the next two years.

To put it in perspective: if even 10% of China’s population drank coffee, it would equal the entire coffee consumption of Europe, the largest buyer of Brazilian coffee today.

In the meantime, in the U.S., industry groups and legal advocates are pushing back. Some conservative legal voices are challenging the legality of Trump’s tariff under the International Emergency Economic Powers Act (IEEPA) because it doesn’t even mention tariffs, and arguably doesn’t permit them under its definition of “extraordinary threat.” Constitutionally, Congress, not the President, is supposed to set taxes on imports.

From a broader perspective, this can be seen as part of a strategy that seeks to secure U.S. dominance over the Western Hemisphere.

We’re seeing efforts to bring Canada closer to U.S. control, to purchase the ports of the Panama Canal, and to influence Latin American elections more directly. If this administration feels that American interests are challenged, it’s likely we’ll see the Monroe Doctrine 2.0—a 21st-century version declaring that interference in American interests by outside powers could be seen as a military threat. Look no further than Trump bombing a vessel off the coast of Venezuela killing 11 people in the process.

In this light, “Tariffs are both revenue generators and geopolitical levers, including against allies,” reports The Hill.

Brazil is an outlier. The U.S. has viewed Brazil as a global competitor since at least the 1980s. And the country is not deeply dependent on the U.S. It has options.

All of this is a direct threat to the kinds of deep, long-term commitments we’ve all built with smallholders. The significant increase of Brazilian coffee will likely mean strong differentials in just about every other coffee producing country. Tariffs and political chips disrupt not only trade, but challenge trust and solidarity in cross-cultural communities like coffee.

So where do we go from here?

First, I think as Americans, we need to tap into something we have always been incredible at: relentless positivity and hope to build a better future.

The challenge is building that future. We’ve grown comfortable with a relatively politically stable global market leading to reliable prices 75% of the time over the last 36 years—especially in the Global North. That’s allowed for low prices for farmers, and affordable, high-quality coffee for buyers. We haven’t needed to push for political structural change in order to enjoy prices on coffee. Now that’s shifting.

We can look to the past and present to see how industry has been politically active when outside actors threaten the survival of our businesses and the world we would like to see.

The NCA and its legal team are lobbying for coffee to be exempt. A bipartisan Coffee Caucus now exists in Congress with over 30 active congressional members. And we can leverage the power of a national trade association with congressional support. There are petitions to advocate for coffee to be exempt from tariffs. These seem to have had some impact and while we await more details it does seem coffee may be exempt.

This is a conversation every single coffee importer, roaster, and retailer should be having. Not just Americans, but everyone. This will impact everyone. American consumers deserve to know how much a 50% tariff will cost them. We can connect with politicians and advocate for exemptions. Work with local businesses and media to raise awareness. Reach out to creators and content channels to amplify the issue.

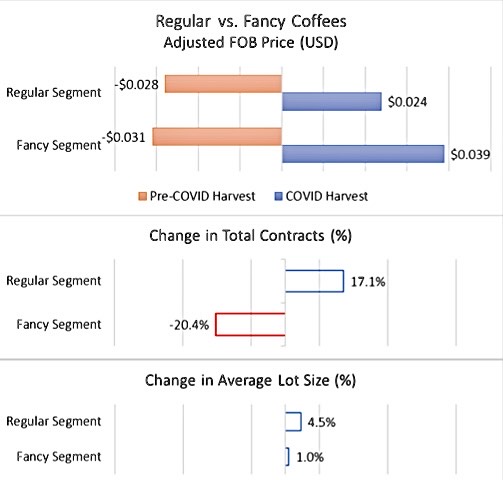

We will collectively have to get creative on fighting for relationship coffee. The alternative will be that specialty coffee will revert into commodity coffee. What I mean is just as commodities are faceless, cheap, and replaceable, the specialty coffee sector risks becoming just as tradeable and faceless. There’s already been a swath of downgrading on quality coffees due to Covid and inflationary pressures. We all know downgrading typically also comes with the cost of sacrificing current relationships, going elsewhere in order to protect margins.

We could take a note out of Gen Z’s playbook, organize, and fight back politically and raise awareness with our consumers. This is a moment that will define what we believe about relationship coffee.

Psychologist and psychoanalyst Esther Perel says the secret of great relationships is all about the effort we put in to make it work. Sustained relationships aren’t seamless but are the outcome of the creative efforts by people who want to make it work. All relationships are a cycle of connection, disconnection and repair. Relationship coffee is no different. And the disconnection from an outside force like tariffs will define our relationships in two ways: either it will awaken us to want to do something different, or rekindle a desire to double down and remind us why we started relationship coffee in the first place.